Warren Buffett and his billionaire buddy Billy Gates corralled another dozen billionaires last week and convinced them to give half their fortunes away to charity. The Buffett, who has more moola than some frontier nations, has been on a ‘giving’ tear even since Bill & Melinda urged him to do so. This gifting of billions is …well…just thinking out-loud- maybe assuaging the soul…or, Socialistic philosophical guilt. Of course there is the tax thing. Getting a deduction for donating is limited if you’re really filthy rich. You may only get a percentage of what you give as a deduction. But, at death your estate benefits by paying less in taxes. The telephone book numbers that Buffett and Gates are giving would reduce enormously their future estate tax. So there is more to this charitable giving than pure benevolence.

Warren Buffett and his billionaire buddy Billy Gates corralled another dozen billionaires last week and convinced them to give half their fortunes away to charity. The Buffett, who has more moola than some frontier nations, has been on a ‘giving’ tear even since Bill & Melinda urged him to do so. This gifting of billions is …well…just thinking out-loud- maybe assuaging the soul…or, Socialistic philosophical guilt. Of course there is the tax thing. Getting a deduction for donating is limited if you’re really filthy rich. You may only get a percentage of what you give as a deduction. But, at death your estate benefits by paying less in taxes. The telephone book numbers that Buffett and Gates are giving would reduce enormously their future estate tax. So there is more to this charitable giving than pure benevolence.  A reduction in the estate tax could possibly leave more real loot for the family, and heirs of the giver than if they didn’t donate. From what I am able to tell the Buffett/Gates’ Rules is such that a billionaire can give away a substantial portion of their assets to any charity, organization or philanthropy that strikes their fancy. It could be for nuclear nonproliferation, feeding the hungry or for the arts. Being left with one billion or half a billion is not going to change a lifestyle like it would if you had a hundred thousand saved and then gave away fifty. Then there is the immortality of the gift and of the gift giver. A library named after the benefactor. A hospital wing with a similar appellation. Plus once a charity is formed, created and a Board nominated; it could be a good place for a relative locking in a lifetime job sitting and dispensing charity.

A reduction in the estate tax could possibly leave more real loot for the family, and heirs of the giver than if they didn’t donate. From what I am able to tell the Buffett/Gates’ Rules is such that a billionaire can give away a substantial portion of their assets to any charity, organization or philanthropy that strikes their fancy. It could be for nuclear nonproliferation, feeding the hungry or for the arts. Being left with one billion or half a billion is not going to change a lifestyle like it would if you had a hundred thousand saved and then gave away fifty. Then there is the immortality of the gift and of the gift giver. A library named after the benefactor. A hospital wing with a similar appellation. Plus once a charity is formed, created and a Board nominated; it could be a good place for a relative locking in a lifetime job sitting and dispensing charity.  The Buffett is also on a crusade to have folks pay more in taxes. He may be talking out loud about millionaires only but don’t let that fool you. He’s on a eventual quest that you, me and the candle stick maker pay more in taxes. For a guy who’s made a ton in Capitalism he does have a streak of Socialistic envy. Which is why the Bush Tax Cuts, that are set to expire at the end of this year, are smack dab in the sights of liberals. The current President, if he has his way, wants them to expire. Nancy Pelosi, a Democrat that’s also loaded, and to the best of my knowledge, hasn’t yet stepped onto the Buffett Charity Train, also wants the tax cuts to expire. When those tax cuts expire it would mean paying more in taxes for the middle-class. About 60% of all tax fillers would see their taxes jump on average $2,700 in Federal taxes in 2013. Capital gains would increase from 15% to 20%, dividends on stocks would be taxed at ordinary income rather than at 15%. A lot more people wouldn’t be trading stocks or selling their winners because it would trigger a tax. No one can argue that money going to government rather than to people or business is inefficient and stifles growth. Still, ABC news reported, some in Congress and in both parties don’t want to see all the Bush tax cuts doomed. We won’t know what happens with those cuts until the end of this year and it all depends on who wins the election. A Barrons.com survey of April 22nd reported what money managers think who would be better for the economy and the stock market.

The Buffett is also on a crusade to have folks pay more in taxes. He may be talking out loud about millionaires only but don’t let that fool you. He’s on a eventual quest that you, me and the candle stick maker pay more in taxes. For a guy who’s made a ton in Capitalism he does have a streak of Socialistic envy. Which is why the Bush Tax Cuts, that are set to expire at the end of this year, are smack dab in the sights of liberals. The current President, if he has his way, wants them to expire. Nancy Pelosi, a Democrat that’s also loaded, and to the best of my knowledge, hasn’t yet stepped onto the Buffett Charity Train, also wants the tax cuts to expire. When those tax cuts expire it would mean paying more in taxes for the middle-class. About 60% of all tax fillers would see their taxes jump on average $2,700 in Federal taxes in 2013. Capital gains would increase from 15% to 20%, dividends on stocks would be taxed at ordinary income rather than at 15%. A lot more people wouldn’t be trading stocks or selling their winners because it would trigger a tax. No one can argue that money going to government rather than to people or business is inefficient and stifles growth. Still, ABC news reported, some in Congress and in both parties don’t want to see all the Bush tax cuts doomed. We won’t know what happens with those cuts until the end of this year and it all depends on who wins the election. A Barrons.com survey of April 22nd reported what money managers think who would be better for the economy and the stock market.

Monday’s WSJ reported that U.S. stocks may have lost their ‘fizz’. Last week the markets were up 199 points and on pace to finish slightly higher in April. That’s the 7th month of gains, and the longest streak in five years. Most traders expect a summer of ‘treading water’, and not much else. Arguments are that most of 2012’s gains have been generated by the Fed, are probably disingenuous. The problem is that according to Bloomberg global investors have pulled the most money from stock funds in any April in at least 17 years. Mutual funds that buy U.S. stocks have had withdrawals of $121 billion in the 12 months ending March 31st, according to Morningstar, Inc. Brian Leung, a global equity strategist at Bank of America Merrill Lynch said it would be hard to generate a rally in global stocks ‘in the absence of big, strong inflows to equity funds.’ Now for what happened last week…

Monday’s WSJ reported that U.S. stocks may have lost their ‘fizz’. Last week the markets were up 199 points and on pace to finish slightly higher in April. That’s the 7th month of gains, and the longest streak in five years. Most traders expect a summer of ‘treading water’, and not much else. Arguments are that most of 2012’s gains have been generated by the Fed, are probably disingenuous. The problem is that according to Bloomberg global investors have pulled the most money from stock funds in any April in at least 17 years. Mutual funds that buy U.S. stocks have had withdrawals of $121 billion in the 12 months ending March 31st, according to Morningstar, Inc. Brian Leung, a global equity strategist at Bank of America Merrill Lynch said it would be hard to generate a rally in global stocks ‘in the absence of big, strong inflows to equity funds.’ Now for what happened last week…

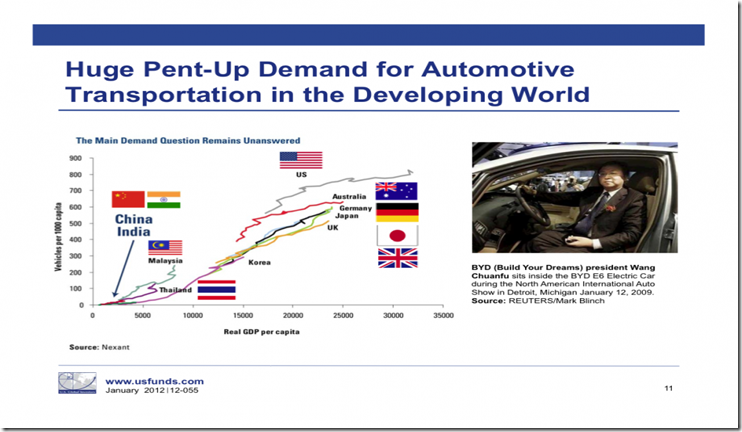

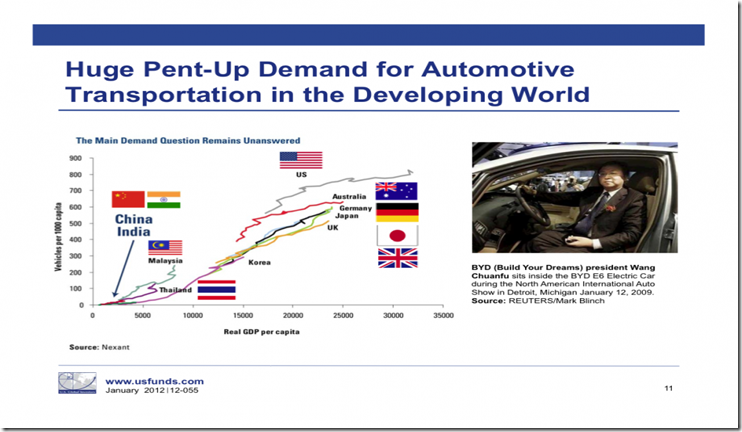

Ford CEO Alan Mulally said, ‘Investor patience will be rewarded.’ Ford again brought good numbers but losses overseas hampered overall growth. Domestic markets did exceptionally well. Shares of Ford fell to close Friday at $11.60. Still the picture for automakers looks bright.

Ford CEO Alan Mulally said, ‘Investor patience will be rewarded.’ Ford again brought good numbers but losses overseas hampered overall growth. Domestic markets did exceptionally well. Shares of Ford fell to close Friday at $11.60. Still the picture for automakers looks bright.

GROSS DOMESTIC PRODUCT first quarter at an annual rate of 2.2% (more later in the blog). The GDP needs to be at 4% to reduce unemployment by 1%.

Facebook Going Public! I am mulling  whether to buy at the open or hold off for a year on this stock. How important is Facebook? Almost a billion people are signed up, according to the numbers I’ve seen, for the social interactive site. Facebook has its own money. Credits are Facebook money. There were 16 billion credits consumed by Facebook users in 2011. It’s estimated that there will be, according to Techinvestornews, of the UK, that there will be 40 billion used in 2012. Facebook gets 30%, based on history, and the balance to merchants. Here’s some more startling facts:

whether to buy at the open or hold off for a year on this stock. How important is Facebook? Almost a billion people are signed up, according to the numbers I’ve seen, for the social interactive site. Facebook has its own money. Credits are Facebook money. There were 16 billion credits consumed by Facebook users in 2011. It’s estimated that there will be, according to Techinvestornews, of the UK, that there will be 40 billion used in 2012. Facebook gets 30%, based on history, and the balance to merchants. Here’s some more startling facts:

- Facebook credits provide seamless currency conversion for 47 currencies, and climbing.

- In 2012 thousands of movies and hundreds of live events will be available on Facebook. Today 89 of the top 100 Facebook pages are entertainment oriented.

- Social gaming will continue to grow with new audiences playing them. There are billions to be made in the market with Facebook taking a piece of the action.

- Big brands and thousand of small brands will use Facebook credits as an incentive tool. From airline miles to rewards company’s will encourage people to visit Facebook and reward them with credits.

- Retail efforts- rather than cash or gift card young consumers will appreciate Facebook credits for holiday and birthdays.

Monday was Nasty  as domestic markets reacted to the mess overseas. It was so bad (How bad was it?) in Europe that the Dutch government fell! The Dutch right wing Freedom Party said that EU demands for budget restraint were ‘impossible’ to meet and quit. They just walked out! The Prime Minister resigned and now the Netherlands will face an early election aimed at trying to keep EU rules and the country’s triple A credit rating. The Dutch are so level headed that you know there’s trouble, with a capital T, in Europe. Expect a long summer and an even longer winter for those folks.

as domestic markets reacted to the mess overseas. It was so bad (How bad was it?) in Europe that the Dutch government fell! The Dutch right wing Freedom Party said that EU demands for budget restraint were ‘impossible’ to meet and quit. They just walked out! The Prime Minister resigned and now the Netherlands will face an early election aimed at trying to keep EU rules and the country’s triple A credit rating. The Dutch are so level headed that you know there’s trouble, with a capital T, in Europe. Expect a long summer and an even longer winter for those folks.

The Dow fell 102 Points.  It could’ve been worse.

It could’ve been worse.

Austerity Topples Romanian Government! Cuts and public sector job losses have left millions of Romanians struggling. There seems to be a move from austerity minded politicians in Romania and other EU poorer countries.

Austerity Topples Romanian Government! Cuts and public sector job losses have left millions of Romanians struggling. There seems to be a move from austerity minded politicians in Romania and other EU poorer countries.

Sum it up…Here was a line in the April 23rd Monday’s WSJ that said it all. It’s all you have to remember when thinking of the problems overseas. It’ll take years for those folks to work there way through the mess we started (and still no high ranking banking or corporate officer in the pokey). The deal in Europe boils down to is: ‘Most of the economies can’t grow their way out of their debt loads, and there isn’t enough political will to finally pull the Continent into something that resembles a United States of Europe that would collectively cover those debts.’

Sum it up…Here was a line in the April 23rd Monday’s WSJ that said it all. It’s all you have to remember when thinking of the problems overseas. It’ll take years for those folks to work there way through the mess we started (and still no high ranking banking or corporate officer in the pokey). The deal in Europe boils down to is: ‘Most of the economies can’t grow their way out of their debt loads, and there isn’t enough political will to finally pull the Continent into something that resembles a United States of Europe that would collectively cover those debts.’

Tuesday was like watching ice melt as the  Dow opened with a fury and ramped up to triple digits and then slowly gave it up. The Naz was down and Gold finished at $1644. (It just can’t get traction). Oil finished over $104. Dow finished at +74.

Dow opened with a fury and ramped up to triple digits and then slowly gave it up. The Naz was down and Gold finished at $1644. (It just can’t get traction). Oil finished over $104. Dow finished at +74.

Something Stinks…a double dip recession is confirmed in the U.K. Wednesday morning, interest rates on bonds in Italy and Spain are at multi-year highs, the Dutch government walked out and news of the European markets rallying is something to make me scratch my head. With all the bad news does someone know something we don’t know?

Something Stinks…a double dip recession is confirmed in the U.K. Wednesday morning, interest rates on bonds in Italy and Spain are at multi-year highs, the Dutch government walked out and news of the European markets rallying is something to make me scratch my head. With all the bad news does someone know something we don’t know?

Apple blew away numbers! The company  stock has been slowing falling and then the news of iPhone sales that were huge. The stock price jumped afterhours on the news Tuesday afternoon. Then it was ‘onto’ the real markets on Wednesday and it was Apple Day! Apple was the engine as shares were up in pre-market about 40 points and added another 10 during the trading day to power the Nasdaq 68 points- best day of the year. The Dow and S&P 500 followed suit with less than that of the Naz but a respectful 89 and 19 point run. Gold was up a tad as was oil. But, all the upside was accomplished right after Apple announced earnings. Morningstar came out with their opinion and remarked that the Apple numbers were simply unsustainable. But, I won’t be one to say that Apple can’t find ways to continue growing its business.

stock has been slowing falling and then the news of iPhone sales that were huge. The stock price jumped afterhours on the news Tuesday afternoon. Then it was ‘onto’ the real markets on Wednesday and it was Apple Day! Apple was the engine as shares were up in pre-market about 40 points and added another 10 during the trading day to power the Nasdaq 68 points- best day of the year. The Dow and S&P 500 followed suit with less than that of the Naz but a respectful 89 and 19 point run. Gold was up a tad as was oil. But, all the upside was accomplished right after Apple announced earnings. Morningstar came out with their opinion and remarked that the Apple numbers were simply unsustainable. But, I won’t be one to say that Apple can’t find ways to continue growing its business.

Michael Kahn technical analyst at Barrons.com whipped out some charts and pointed to the obvious that while Apple news was welcomed it could not reverse technical breakdowns already in place in major indexes. The traditional weak summer months still loom large. Kahn points to the Russell 2000 index and writes that the average itself has already started to roll over to the downside, ‘meaning the trend is already officially declining.’

Wednesday the Ben Bernanke told the markets  that the Fed policy was unchanged and that now was the time for the politicians to get their acts together. These were words that were not new and didn’t surprise investors who were probably bathing in Apple Juice and weren’t really concentrating. Expect the Fed not to raise rates until 2014. Also don’t look for the Fed to help unless the wheels really fall off.

that the Fed policy was unchanged and that now was the time for the politicians to get their acts together. These were words that were not new and didn’t surprise investors who were probably bathing in Apple Juice and weren’t really concentrating. Expect the Fed not to raise rates until 2014. Also don’t look for the Fed to help unless the wheels really fall off.

Coke may split 2-1 this August.  Jeff Reeves at MarketWatch recommends buying Coke before the board approves the split because…the shares will go up because they usually do when shares of good company’s stock split. He writes that you should try to buy Coke on a dip. Once split the shares will rise when nothing else will happen. Profits won’t increase, revenue won’t be there. The price of Coke at the grocery store, Jeff writes, won’t change. For some reason he says, Coke shares will pop after the split. His final reasoning is even if shares don’t pop you’ll end up owning a great company.

Jeff Reeves at MarketWatch recommends buying Coke before the board approves the split because…the shares will go up because they usually do when shares of good company’s stock split. He writes that you should try to buy Coke on a dip. Once split the shares will rise when nothing else will happen. Profits won’t increase, revenue won’t be there. The price of Coke at the grocery store, Jeff writes, won’t change. For some reason he says, Coke shares will pop after the split. His final reasoning is even if shares don’t pop you’ll end up owning a great company.

Thursday an Apple Market Continuation? It was happy-happy with a triple digit day except….Transports down when everything else was up. I wrote about this before and you need to have the manufacturing side going well and you need to have an equally strong delivery system to get it to the public.If you don’t no one is buying what you are making. Capiche?  In fact Thursday marked the S&P 500 index Biggest 3 day run since February. Still Mark Hulbert @ MarketWatch reminded us all that the Transport Index (a primary index in the Dow Theory has lagged significantly the Dow. The DJT/ Transport Index is off 7% from its July 2011 high. Like the cop on Hill Street Blues used to say, ‘Be careful out there.’

In fact Thursday marked the S&P 500 index Biggest 3 day run since February. Still Mark Hulbert @ MarketWatch reminded us all that the Transport Index (a primary index in the Dow Theory has lagged significantly the Dow. The DJT/ Transport Index is off 7% from its July 2011 high. Like the cop on Hill Street Blues used to say, ‘Be careful out there.’

My Favorite Store is Amazon. Stock holders have been frustrated with  Jeff Bezos who has been spending money on infrastructure to house and deliver goods to customers. This spending spree has held back the share price but Thursday the stock soared on rapid sales growth even though profit dropped by 35%. While operating margins decreases its only time before they catch up to the efficiencies of the company. I do most of my Christmas shopping at Amazon…

Jeff Bezos who has been spending money on infrastructure to house and deliver goods to customers. This spending spree has held back the share price but Thursday the stock soared on rapid sales growth even though profit dropped by 35%. While operating margins decreases its only time before they catch up to the efficiencies of the company. I do most of my Christmas shopping at Amazon…

Bloomberg Reported. ‘We’re in a correction,’Mary Ann Bartels, the New York based head of technical and market analysis at Bank of America, said in a phone interview Wednesday last to Bloomberg reporters. ‘We’re starting too get sell signals on our intermediate indicators. Industries such as consumer staples, telecommunications and utilities have fallen too much as investors favor more defensive industries. The market is still staying away from commodity sensitive cyclicals. As long as that continues, that means the market is more likely to go down.’

Bloomberg Reported. ‘We’re in a correction,’Mary Ann Bartels, the New York based head of technical and market analysis at Bank of America, said in a phone interview Wednesday last to Bloomberg reporters. ‘We’re starting too get sell signals on our intermediate indicators. Industries such as consumer staples, telecommunications and utilities have fallen too much as investors favor more defensive industries. The market is still staying away from commodity sensitive cyclicals. As long as that continues, that means the market is more likely to go down.’

A Cheap Dollar Good For Stocks & Gold! According to ETF News. Watch as the dollar falls and stocks and gold increase.

Business Insider conducted its own  unofficial ‘bubble’ report on Gold and when a NY beer delivery driver ‘agreed’ to take gold as payment for beer, knowing what it was worth, the writer predicted that gold is a bubble waiting to happen. Back in the Dot Com Day Trading Days everyone knew more about stocks than those in the business. It was only a matter of time when the Day Traders were punished with the 2000 market meltdown that the Nasdaq has not recovered from.

unofficial ‘bubble’ report on Gold and when a NY beer delivery driver ‘agreed’ to take gold as payment for beer, knowing what it was worth, the writer predicted that gold is a bubble waiting to happen. Back in the Dot Com Day Trading Days everyone knew more about stocks than those in the business. It was only a matter of time when the Day Traders were punished with the 2000 market meltdown that the Nasdaq has not recovered from.

Last Week Ran on Gas From Apple & Amazon!  Better than expected earnings boosted the markets last week. Friday last the markets still continued its run as Amazon moved higher. The problem was the GDP number of 2.2% versus estimated 2.5% and lower than the fourth quarter of 2011 of 3%. Stephanie Pomboy of MacroMavens explained that with nominal consumer spending slowing to a 3.5% year-over-gain, ‘the trend in revenue growth is hardily encouraging companies to expand.’ (GDP is the total value of goods and services produced over a specific time period and is used to judge the health of a country).

Better than expected earnings boosted the markets last week. Friday last the markets still continued its run as Amazon moved higher. The problem was the GDP number of 2.2% versus estimated 2.5% and lower than the fourth quarter of 2011 of 3%. Stephanie Pomboy of MacroMavens explained that with nominal consumer spending slowing to a 3.5% year-over-gain, ‘the trend in revenue growth is hardily encouraging companies to expand.’ (GDP is the total value of goods and services produced over a specific time period and is used to judge the health of a country).

Ten Year Bond …yields fell Friday when  demand sent bonds to their lowest in two months. The 1o-year has, for many years, replaced the 30-year as a measurement of safety. The economists fear that when the 10-year yield is at or higher than the GDP the country is in serious trouble. With 2.2% GDP and 1.98% yield on the 10-year there is little room to wiggle. It also tells us that the Bernanke is not going to raise rates anytime soon. There is, according to the Friday WSJ, a clear slowing of activity and a dashed hope that the economy would grow faster.On CBS news Friday trucking executive said to Anthony Mason that looking ahead six months the company would be okay but just getting by.

demand sent bonds to their lowest in two months. The 1o-year has, for many years, replaced the 30-year as a measurement of safety. The economists fear that when the 10-year yield is at or higher than the GDP the country is in serious trouble. With 2.2% GDP and 1.98% yield on the 10-year there is little room to wiggle. It also tells us that the Bernanke is not going to raise rates anytime soon. There is, according to the Friday WSJ, a clear slowing of activity and a dashed hope that the economy would grow faster.On CBS news Friday trucking executive said to Anthony Mason that looking ahead six months the company would be okay but just getting by.

Proctor & Gamble manufactures some of my favorite products. A partial list includes Gillette,  Crest, Oral-B, Downy, Bounty, Duracell. Scope, Tide and Swifter. Visit my house and I keep a second shift working at one P&G factory or another. So with all these great products why is the stock in the toilet? Sales at P&G are up only 3% while rivals at Unilever and Colgate are up 8.5% and 6.5%. On Friday the CEO, Robert McDonald, at an analyst meeting, took to falling on his sword saying it was his fault the stock fell 3.6%, the biggest drop in 2 1/2 years. The company announced job and price cuts going forward. Increase in commodity costs have hurt P&G’s bottom line. Shares closed $65., little changed in 2 years while Colgate is up 17% and Unilever 13% over the same period. Clearly more problems in the giant conglomerate than what meets the eye.

Crest, Oral-B, Downy, Bounty, Duracell. Scope, Tide and Swifter. Visit my house and I keep a second shift working at one P&G factory or another. So with all these great products why is the stock in the toilet? Sales at P&G are up only 3% while rivals at Unilever and Colgate are up 8.5% and 6.5%. On Friday the CEO, Robert McDonald, at an analyst meeting, took to falling on his sword saying it was his fault the stock fell 3.6%, the biggest drop in 2 1/2 years. The company announced job and price cuts going forward. Increase in commodity costs have hurt P&G’s bottom line. Shares closed $65., little changed in 2 years while Colgate is up 17% and Unilever 13% over the same period. Clearly more problems in the giant conglomerate than what meets the eye.

Finally…  back at work. The FDIC closed four banks last Friday bringing the total year to date to 21.

back at work. The FDIC closed four banks last Friday bringing the total year to date to 21.

Questions call Paul @ 877 783 7080 or write him at pstanley@westminsterfinancial.com. Share this blog with someone who cares about their money.