Two stories from people with ideas ( one good and one not so ) from last week…. Mark Mobius is Chairman of Templeton Emerging Markets Group and he has a plan for 2012 and beyond. The other story takes us to The Suze Orman who has hooked up with a dubious portfolio manager to manage her ‘people’s money. She is also hawking her new debit card to ‘help’ her fans in getting their finances straight.

Two stories from people with ideas ( one good and one not so ) from last week…. Mark Mobius is Chairman of Templeton Emerging Markets Group and he has a plan for 2012 and beyond. The other story takes us to The Suze Orman who has hooked up with a dubious portfolio manager to manage her ‘people’s money. She is also hawking her new debit card to ‘help’ her fans in getting their finances straight.

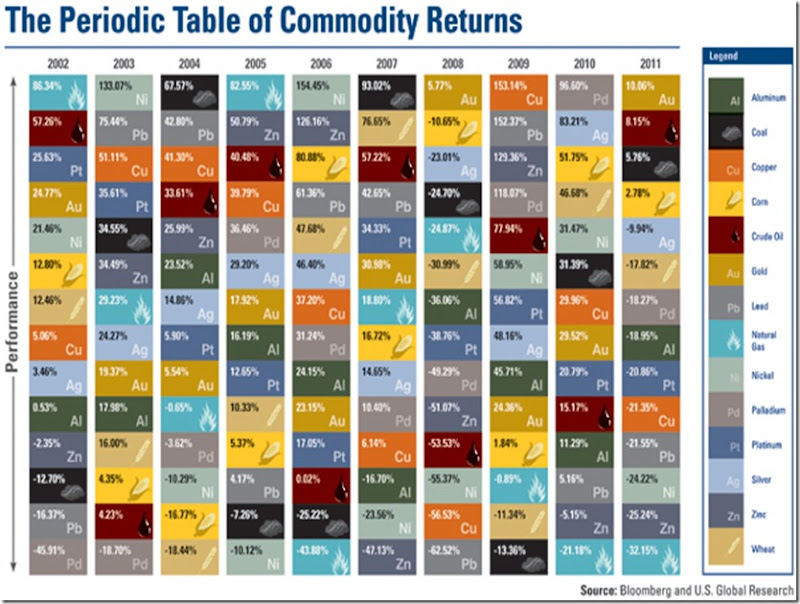

Mobius, who oversees billions in investor money at Templeton, is a confirmed Euro Bull. (As a pretty smart guy who works with money 24-7 I’d call him an expert on what’s happening in Europe over some radio or TV talking head.) In a MarketWatch interview the Doctor said he thought the euro could play a greater role in the global economy by 2020. His ideas for global investors include: (1) Stick with energy- everyone needs electricity. (2)Software delivers hard profits – Great Indian companies such as Tata Consulting. (3) Have confidence in consumers. Buy companies that consumers buy from. (4) Commodities and materials are building blocks. He expects the global demand for all commodities to continue to grow.

Mobius, who oversees billions in investor money at Templeton, is a confirmed Euro Bull. (As a pretty smart guy who works with money 24-7 I’d call him an expert on what’s happening in Europe over some radio or TV talking head.) In a MarketWatch interview the Doctor said he thought the euro could play a greater role in the global economy by 2020. His ideas for global investors include: (1) Stick with energy- everyone needs electricity. (2)Software delivers hard profits – Great Indian companies such as Tata Consulting. (3) Have confidence in consumers. Buy companies that consumers buy from. (4) Commodities and materials are building blocks. He expects the global demand for all commodities to continue to grow.

On the flip side we have Suze Orman ( who calls herself ‘The Personal Financial Expert of the World’) and who has hooked up with Mark Grimaldi, an investment manager in Wappingers Falls, N.Y. ( Not exactly a household name in the business.) He manages about $120 million, which, Jason Zweig calls, a minnow in the money management business. Orman and Grimaldi are in biz together, although the relationship isn’t as clear as one would like. Orman touts Grimaldi for her clients and Grimaldi brags about his management returns which he states produced an average of 10.25% from August, 2002 to October, 2011. The problem is that the fund wasn’t launched into December, 2009. There’s more but I’ll let you research. Suze also is promoting her new debit card.

On the flip side we have Suze Orman ( who calls herself ‘The Personal Financial Expert of the World’) and who has hooked up with Mark Grimaldi, an investment manager in Wappingers Falls, N.Y. ( Not exactly a household name in the business.) He manages about $120 million, which, Jason Zweig calls, a minnow in the money management business. Orman and Grimaldi are in biz together, although the relationship isn’t as clear as one would like. Orman touts Grimaldi for her clients and Grimaldi brags about his management returns which he states produced an average of 10.25% from August, 2002 to October, 2011. The problem is that the fund wasn’t launched into December, 2009. There’s more but I’ll let you research. Suze also is promoting her new debit card.  For years Suze has harped on people buying and using only those products with low costs and fees. According to Chuck Jaffe the card has 20 ways to charge a fee and allow The Orman to make money off her vast, adoring and trusting audience. More than one way to shear sheep…

For years Suze has harped on people buying and using only those products with low costs and fees. According to Chuck Jaffe the card has 20 ways to charge a fee and allow The Orman to make money off her vast, adoring and trusting audience. More than one way to shear sheep… eh, Suze?

eh, Suze?

Too Often Investors Give Credit to So-Called Experts that have ulterior motives.

*** This week starts with European meeting in Brussels. Germany wants a say in Greek national budget and Greece minister says, no. They will handle their own budget, thank you very much. According to David Marsh at Dow Jones expect typical political public posturing that may not bode well for our domestic stock markets.

This week starts with European meeting in Brussels. Germany wants a say in Greek national budget and Greece minister says, no. They will handle their own budget, thank you very much. According to David Marsh at Dow Jones expect typical political public posturing that may not bode well for our domestic stock markets.

Facebook will file this week for its Initial Public Offering. The value will be in the neighborhood of $100 billion. Expect shares to trade sometime before May. Now for news of last week….

Last Monday markets pulled back a smidge. Overall volatility has been tame. Money is again flowing into domestic markets from overseas and institutional investors. According to Justin Bennett, in his Dynamic Wealth Report, expect a pullback even though stocks have broken through resistance.  Institutional money pouring in is more of a fear of the train leaving the station than anything else. Historically, the last 2 years, the stock market has weakened the last two weeks in January.

Institutional money pouring in is more of a fear of the train leaving the station than anything else. Historically, the last 2 years, the stock market has weakened the last two weeks in January.

WSJ- Investors may have positioned themselves for a European collapse. Still some are concerned about the quick rise in the markets.  Dennis Gartman of the Gartman Letter expressed his concern saying, ‘We’re antsy.’ Which is technical investor talk…

Dennis Gartman of the Gartman Letter expressed his concern saying, ‘We’re antsy.’ Which is technical investor talk…

China  alive and well, according to Frank Holmes at US Global Investors and writing in Business Insider. He provides the following:

alive and well, according to Frank Holmes at US Global Investors and writing in Business Insider. He provides the following:

- China inflation tempered with China raising interest rates three times in 2011. Plus requiring increased reserves each month for the first six months last year.

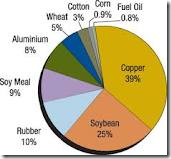

- Copper Inventories Increase. The Price of Copper has risen as China has restocked depleted supplies.

- Energy reliance has shifted as more energy imported.

And lets not forget it’s the year of the Dragon!

Natural Gas Glut. More energy companies have switched their focus from gas to oil. Prices of natural gas fell to 2 year lows. An abundance of the  commodity is causing some producers to ‘flare’ away gas from wells. Four years ago natural gas sold for $9.00 per million BTUs. Bank of America estimates it could sell soon for less than $2.00. There will soon be a trade in NG.

commodity is causing some producers to ‘flare’ away gas from wells. Four years ago natural gas sold for $9.00 per million BTUs. Bank of America estimates it could sell soon for less than $2.00. There will soon be a trade in NG.

Germany will close all nuclear plants by 2022- according to BBC. Citing worries over safety  the German government will close all plants and have to replace their energy with more traditional fossil fueled plants. The atomic energy used is about 23% of current energy needs. Commodities worldwide will see increased costs. I would expect natural gas to slowly increase after falling to multi-year lows.

the German government will close all plants and have to replace their energy with more traditional fossil fueled plants. The atomic energy used is about 23% of current energy needs. Commodities worldwide will see increased costs. I would expect natural gas to slowly increase after falling to multi-year lows.

Campaign Numerology- Economist Douglas Hibbs, Jr. for 2 decades used a simple  formula to predict presidential winners. He uses a a real income growth calculation with more weight given to an incumbent’s time in office. His results show that the President is a massive underdog and headed for a huge defeat.

formula to predict presidential winners. He uses a a real income growth calculation with more weight given to an incumbent’s time in office. His results show that the President is a massive underdog and headed for a huge defeat.

Art = +10.2% in 2011

Impressionist and modern art outperformed Old Masters by 14% versus 4.8% info from Bill Saporito at January 20 2012 Time Magazine.

Avoiding Poverty – study shows only a 2%  chance of falling into poverty if a person graduates from high school and has children after getting a job.

chance of falling into poverty if a person graduates from high school and has children after getting a job.

Bloomberg Reports…. A Greek Default You Can Mark on Your Calendar. It’s March 20th  and Greece simply doesn’t have the $18.5 billion it owes bondholders. If the date comes and the default is…less than orderly, than you can expect spreading panic. Apple has over $100 billion tucked away….

and Greece simply doesn’t have the $18.5 billion it owes bondholders. If the date comes and the default is…less than orderly, than you can expect spreading panic. Apple has over $100 billion tucked away…. On Friday WSJ announced Athens and creditors may have reached a deal. The deal is to hand in current high interest bonds for low interest new bonds. There is about $260 billion outstanding and if not enough private holders turn in their bonds willingly than Greece could transform the deal to a coercive default. In which case the insurance on Greek bonds kicks in and pays private bond holders.

On Friday WSJ announced Athens and creditors may have reached a deal. The deal is to hand in current high interest bonds for low interest new bonds. There is about $260 billion outstanding and if not enough private holders turn in their bonds willingly than Greece could transform the deal to a coercive default. In which case the insurance on Greek bonds kicks in and pays private bond holders.

Odd Numbers? In 1960 3% of American couples had a college degree.  In 2010 25% of same have degrees. In1970 the average CEO made $1 million, in 2006 the average CEO made $16 million.

In 2010 25% of same have degrees. In1970 the average CEO made $1 million, in 2006 the average CEO made $16 million.

Apple Keeps Running! Worries about  the company without Jobs have been put to rest as the company’s profit more than doubled and increased about $10 billion more than analysts expected. The stock soared about 5% in after hours trading.

the company without Jobs have been put to rest as the company’s profit more than doubled and increased about $10 billion more than analysts expected. The stock soared about 5% in after hours trading.

Apple now surpasses Exxon as the Biggest Company in The World & Many Investors still Think Shares May be Cheap!

McDonalds Still Offers Sizzle  according to Teresa Revas at Barrons the company had same store increase of 9.8% in the U.S. and 10.8% in Europe and 6.5 %in Asia. The stock is up close to 10% since November, 2011.

according to Teresa Revas at Barrons the company had same store increase of 9.8% in the U.S. and 10.8% in Europe and 6.5 %in Asia. The stock is up close to 10% since November, 2011.

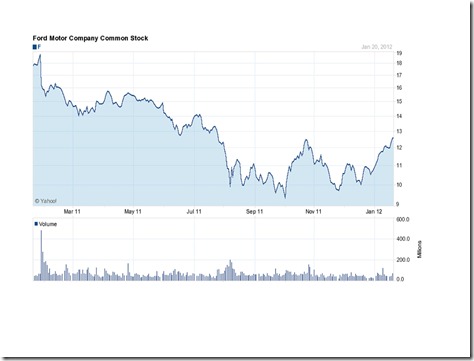

Ford reinstated its quarterly divided of 5 cents a  share. Seeking Alpha Blogger says in short run the stock he would be a seller into anything over $13.00 and be a buying opportunity on any pullbacks at or below $11.00.

share. Seeking Alpha Blogger says in short run the stock he would be a seller into anything over $13.00 and be a buying opportunity on any pullbacks at or below $11.00.  Ford missed expectations by a nickel a share Friday and stock punished. Morningstar states that while revenue was up profits per share were down. Flooding in Asia cost the company about 32,000 units. Ford states they expect weakness in Europe in 2012. Shares fair value by Morningstar still at $23.00. F closed a tad over $12.00

Ford missed expectations by a nickel a share Friday and stock punished. Morningstar states that while revenue was up profits per share were down. Flooding in Asia cost the company about 32,000 units. Ford states they expect weakness in Europe in 2012. Shares fair value by Morningstar still at $23.00. F closed a tad over $12.00

Survey of CEOs shows pessimistic attitude about the global economy.

PriceWaterhouseCoopers, International, reported 48% of CEOs said they expected the global economy to decline. Confidence was in short supply in Western Europe. China was also not immune from a decline in sentiment with only 51% saying they were positive about the Chinese economy down from 72% last year. This survey was taken of 1,258 CEOs from 60 countries in the last quarter of 2011.

Expect to Pay More For Gasoline This Spring.  It’s all about reduction in refining capacity. Expect to pay about$4.00 a gallon starting around March.

It’s all about reduction in refining capacity. Expect to pay about$4.00 a gallon starting around March.

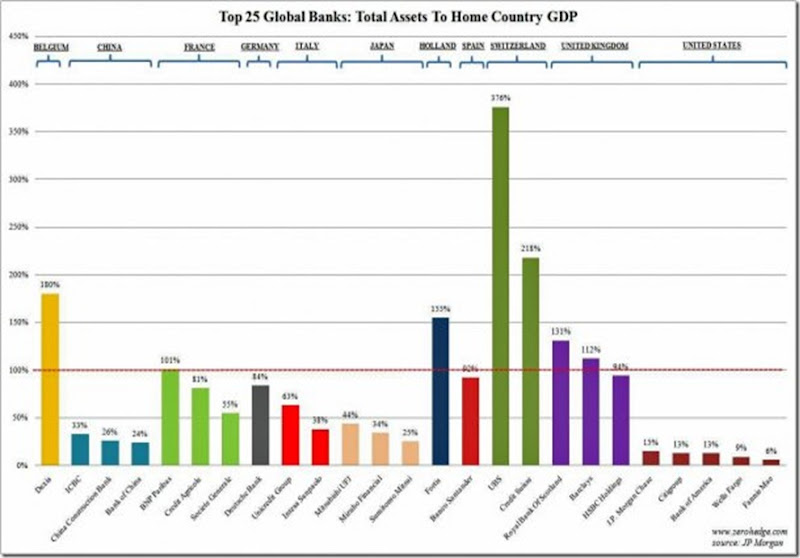

Markets Moved on Fed Announcement – Low Rates Through 2014! More money to be printed  as Fed promises to keep rates at effective Zero for at least two years. With a slight improvement in the economy the Fed announced continued economic weakness. Keeping rates low will accomplish three things:

as Fed promises to keep rates at effective Zero for at least two years. With a slight improvement in the economy the Fed announced continued economic weakness. Keeping rates low will accomplish three things:

- Supposed motivation to spur economic activity.

- Banks will continue not loaning.

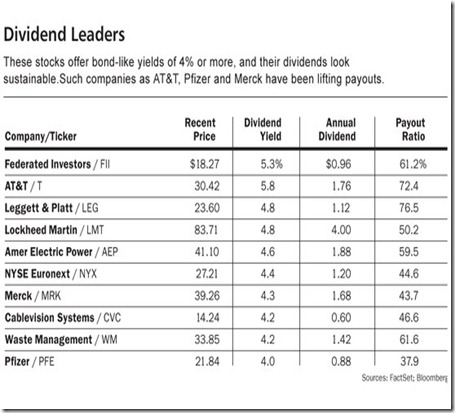

- Savers will be forced to look for safe yield anywhere but the guaranteed sector.

Extending maturities to increase yield make sense at this point.

Extending maturities to increase yield make sense at this point.

Speaking of The Fed…. The Business Insider reports that the Federal Reserve is worried and we  should be too. Disposable income is growing slowly, the consumer is back to being prudent with their money and new hiring is disappointing. Companies are increasing their use of robotics replacing people because robots do not fall into the Administration’s confusing regulations and wish lists. Without a new pro-business approach from Washington The Fed and the rest of us will follow suit and worry and muddle along.

should be too. Disposable income is growing slowly, the consumer is back to being prudent with their money and new hiring is disappointing. Companies are increasing their use of robotics replacing people because robots do not fall into the Administration’s confusing regulations and wish lists. Without a new pro-business approach from Washington The Fed and the rest of us will follow suit and worry and muddle along.

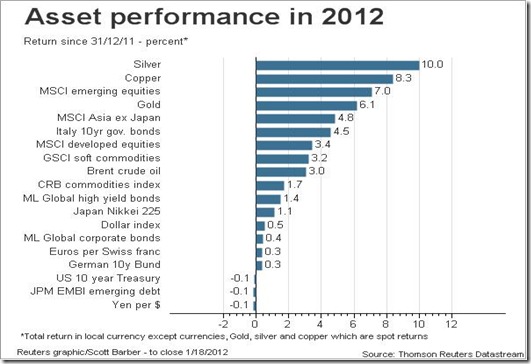

Surprise! A Hedge Fund That Made Money in 2011! Bridgewater  Associates made 23% in 2011. They did it by buying U.S. Treasuries, German Bonds and Japanese Yen. This year the firm states its bullish on gold versus inflation and emerging market currencies.

Associates made 23% in 2011. They did it by buying U.S. Treasuries, German Bonds and Japanese Yen. This year the firm states its bullish on gold versus inflation and emerging market currencies.

Commodities Crashed in 2011- WSJ reports a huge exodus abandoning copper, cotton and corn.  Open interest in 13 key commodities dropped from 10.7 million contracts to 8.7 million last year. The collapse ( may we mention) of commodity trading firm MF Global Holdings also (likely) contributed to the decline. Some interest percolating in 2012 but analysts say investors won’t step back in until the early January rally gains momentum.

Open interest in 13 key commodities dropped from 10.7 million contracts to 8.7 million last year. The collapse ( may we mention) of commodity trading firm MF Global Holdings also (likely) contributed to the decline. Some interest percolating in 2012 but analysts say investors won’t step back in until the early January rally gains momentum.

Markets fell slightly Thursday on worse than expected housing sales….

From Weekday Trader in Barrons.com… Halliburton is the second largest oilfield services company and has a court date end of February  regarding its culpability in the BP disaster. A possible $1 billion settlement could come, in which case expect HAL to reverse trend. It has a possible 40% upside, especially with earnings expected to jump 19% this year. HAL has over $2 billion in cash and analysts say the market isn’t giving the company credit after the Gulf disaster. Morningstar loves the stock giving it 5 stars, a buy at anything at or under $50.00 and a fair value of $72. The stock closed Thursday at $36.88.

regarding its culpability in the BP disaster. A possible $1 billion settlement could come, in which case expect HAL to reverse trend. It has a possible 40% upside, especially with earnings expected to jump 19% this year. HAL has over $2 billion in cash and analysts say the market isn’t giving the company credit after the Gulf disaster. Morningstar loves the stock giving it 5 stars, a buy at anything at or under $50.00 and a fair value of $72. The stock closed Thursday at $36.88.

Is it just me or do you want to yell at Washington to ‘get to work!’

Is it just me or do you want to yell at Washington to ‘get to work!’

It Isn’t Just Me…. Ford CEO Mulally said on interview with CBSs Scott Pelley Friday in answer to why businesses were not spending part of the $1 trillion in cash reserves to hire people. ‘Most people want to buy a new car. But until they start to get some confidence- that they know where we’re going as a country…. it’s going to be very hard for them to make big decisions.’

Ford CEO Mulally said on interview with CBSs Scott Pelley Friday in answer to why businesses were not spending part of the $1 trillion in cash reserves to hire people. ‘Most people want to buy a new car. But until they start to get some confidence- that they know where we’re going as a country…. it’s going to be very hard for them to make big decisions.’

Dogs of The Dow = Total Return 2011:

17.2%! a few weeks back I wrote about

the Dogs of The Dow and how to implement that investment plan- Bloomberg reported the Dogs returns for last year and why the Dogs may well perform going forward as Blue Chip Dividend Paying stocks are now in favor. Wanna know how to create such a portfolio, or buy a fund that uses that method, call or e mail me.

You A Gambler? Here’s the House Edge on  some of the most popular casino games:

some of the most popular casino games:

- Craps 0.60%

- Blackjack 0.80%

- Baccarat (banker) 1.17%

- Baccarat (player) 1.63%

- Roulette (single zero) 2.7%

- Roulette (double zero) 5.26%

- Keno 25%

A one-cent copper coin minted in 1793 (not this Penny)

sold for a record $1.38 million at Heritage Auctions event held during the annual Florida United Numismatists convention.

sold for a record $1.38 million at Heritage Auctions event held during the annual Florida United Numismatists convention.  Not this penny, either. It’s the only pic of a penny I had on file…

Not this penny, either. It’s the only pic of a penny I had on file…

That Big Football Game coming up on February 5th could generate as much as $11 billion  in consumer spending! This from new TVs to snacks, food and beer. Its estimated over 5 million people will buy a new TV simply to watch the game.

in consumer spending! This from new TVs to snacks, food and beer. Its estimated over 5 million people will buy a new TV simply to watch the game.

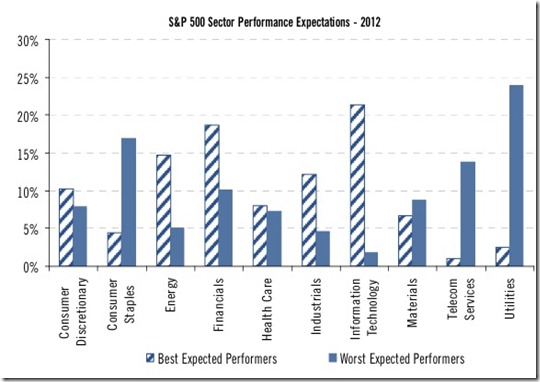

Mixed Markets Friday. The 3 week win streak comes to a halt. The Dow is up about  3% for 2012 and that’s enough to give it a rest. The Nasdaq, oil and gold all up. Materials and healthcare held up the markets on Friday while utilities and consumer staples lagged. Seagate Technology was up almost a buck as it announced an aggressive buyback plan of $1 billion and dividend was increased.

3% for 2012 and that’s enough to give it a rest. The Nasdaq, oil and gold all up. Materials and healthcare held up the markets on Friday while utilities and consumer staples lagged. Seagate Technology was up almost a buck as it announced an aggressive buyback plan of $1 billion and dividend was increased.

Finally…four more banks closed last Friday, according to the  Huffington Post. All four found buyers and spent the weekend changing over for customers Monday. Closures were 2 in Tenn, 1 in Florida and 1 in Minnesota.

Huffington Post. All four found buyers and spent the weekend changing over for customers Monday. Closures were 2 in Tenn, 1 in Florida and 1 in Minnesota.

Questions call Paul @ 877 783 7080 or write him at pstanley@westminsterfinancial.com. Share this blog with someone who cares about their money.

Questions call Paul @ 877 783 7080 or write him at pstanley@westminsterfinancial.com. Share this blog with someone who cares about their money.